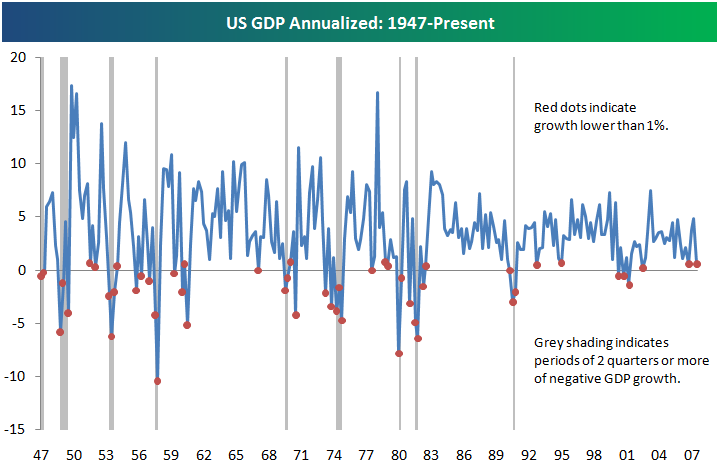

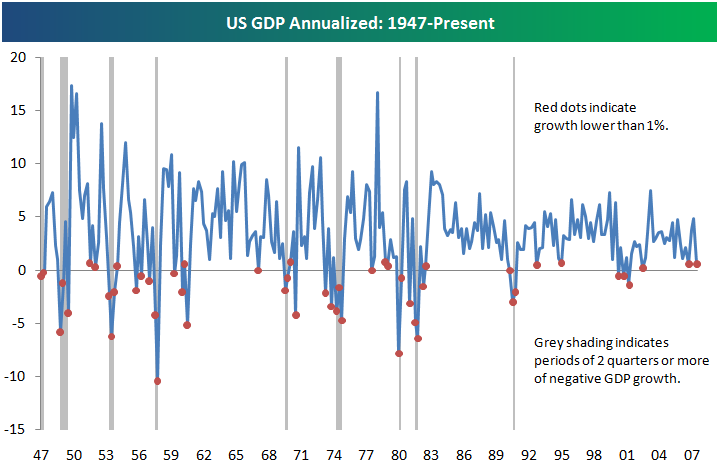

I have to be honest … I get sicker and sicker of “the new normal” each time I hear about it … even though I must admit that upon reflection I did find the recent article from McKinsey Quarterly’s Strategy Practice on Navigating the New Normal to be hilarious. For a while I couldn’t put my finger on why I couldn’t stand hearing about “the new normal”, but then it hit me. There’s no such thing as a new normal … just the old normal coming back after an extended 15 year hiatus. After all, if you think back to before 1995 and before the leading edge of the first tech boom, you see a slow, steady growth in the year-over year stock indices going back to 1975*1. And if you look at the annualized GDP data in the same time frame, you see that growth went up and down, usually between -7% and 7%, over time*2, but averaged out to slow, steady growth*3.

Not only does this mean, as the McKinsey Quarterly article pointed out, that (continual) market growth of 5% to 7% is a thing of the past, but that you have to go back to the good old days where your growth is going to be at the expense of your competitor’s loss. That means that you are going to have to buckle down and build better products, create better services, and offer them at a better price point than your competitors. In other words, the days of new markets and free growth are over.

And while I agree with the leading “strategists” that you are going to have to limit growth plans to “growth above market” and adapt to changing conditions on a quarterly basis, I am fed up about this bullshit about having to go to shorter and shorter planning cycles. That’s why the economy is in the gutter. No more long term thinking. No more research labs. No more support for long term research projects in academia (where it’s now “publish another paper, no matter how trivial, tomorrow or perish”). It’s one thing to be on short production cycles … as that lets you adapt to changing market conditions. But it’s another thing to not be planning beyond three years. It’s just crazy. We need to get back to the days where companies not only had five year plans, but ten year plans … and even longer term plans where innovation roadmaps were concerned. Until we do, I don’t see things getting much better. But in the meantime we’ll get lots of five page articles on discussions with “leading” Chief Strategy Officers who, in long winded diatribes, essentially tell us that they don’t know where things are going … which is exactly what you get when you stop planning for the future.

*1 Comparison of the Dow Jones Industrial Average, NASDAQ Composite, and S&P 500 after 1975

*2 Annualized US GDP Growth from 1947-Present

*3 US Gross Domestic Product 1947-Present

Share This on Linked In