We’ve never covered Coupa Supply Chain Solutions (for Design and Planning), formerly known as Llamasoft, here on Sourcing Innovation, but the doctor did contribute to some of the coverage over on Spend Matters, including the acquisition coverage (Functional Overview, Overlap Between Direct Procurement and Supply Chain, and Procurement, Finance, and Supply Chain Use Cases [Content Hub Subscription Required]) in 2020. Llamasoft / Coupa Supply Chain Design and Planning has also been more recently covered by Spend Matters’ Pierre Mitchell as part of his analysis of Coupa for Supply Chain Management overall. For those interested with a ContentHub subscription, see his pieces on Can Coupa manage supply as well as spend?, Coupa’s journey from Business Spend Management to Supply Chain Management: Assessing progress on seven key dimensions, and From Spend to Supply — Coupa’s direct spend management progress.

Coupa Supply Chain Solutions consists of four main offerings:

- Supply Chain Modeller: the core solution, that can be used offline on the desktop (Supply Chain Guru) as well as online in the cloud, where you build network, inventory, and transportation models for optimization and exploration through the dynamic reporting and dashboard creation module; note that the online version can process multiple “what-if” optimization models simultaneously

- Supply Chain App Studio: the online solution which allows users to build custom interfaces to the underlying model that can be, if desired, custom designed for different user types (procurement, logistics, demand planners, etc.) and then shared with those users who can use the app for regular analysis and what-if optimization

- Demand Modeller: for demand modelling and forecasting — not covered in this article

- Supply Chain Prescriptions: uses machine learning and AI to identify savings opportunities from changes to transportation and inventory models, as well as to identify risk mitigation scenarios, based upon the current supply chain design

In this article we are going to primarily cover the capabilities of the Modeller / App Studio and the Prescriptions which is the core of their supply chain (design and planning) solution suite.

The Modeller has three primary components:

- Model : where you build the models

- Explore : where you build what-if scenarios, that are then optimized

- Results : the outputs of the what-if scenarios

Model building is quite easy. It’s simply a matter of selecting, or uploading, a set of data tables for each relevant supply chain entity. They can be pulled in from a relational database or from a CSV file in standard row-based column format. As long as the column headers have standard field names, the SCP solution can auto detect what entity the table represents (warehouse, lane, transportation mode, etc.) and what data is provided on the entity. It understands all the common elements of supply chain modelling, common names and representations, and appropriate business rules that can do all of the auto mappings.

When you pull in a table, and it does the mappings to the standard internal models, it also automatically analyzes and validates the data. It makes sure all entries are unique, key values required for the types of analysis supported are there (such as coordinates for warehouses, costs per distance for transportation modes, stock levels and associated product requirements for inventory), etc. and flags any conflicting, missing, or likely erroneous data for user review and correction.

When you go to build a scenario, it understands what is required in the base underlying model and validates that all of the necessary data is present. If data is missing, it warns you and gives you a chance to provide the missing data. (Furthermore, as you add constraints to the scenario, the platform understands the data is required and ensures that data is present as well before it tries to run the scenario.)

The application was designed for ease of use and speed, tailored for automating most of the model building process for standard network/inventory/transportation scenarios (including setting parameters and defaults) so that standard models can be built for analysis quick and easy (and it is also quick and easy to change or override any default as needed).

Explore provides the capability where you build scenarios for what-if? exploration.

Building scenarios is simple. You simply select the scenario requirements, or constraints, from a set of existing, or newly created, scenario items that define the parameters of the scenario. For example, for a network optimization, you might want to explore limiting the number of existing distribution hubs or adding more proposed nodes to see if you can reduce cost, carbon, or distribution time. For transportation, you might want to explore adding in rail to a network that is currently all truck to see if you can decrease cost. For inventory, you might want to reduce the number of locations where safety stock for rarely used components is stored (so you can limit the number of locations with a low turn rate and minimize the warehouse size/footprint you need at those locations) and see what happens and so on. Each scenario is built from a set of specifications that specify the restrictions that you want to enforce, which could even be a reduction in the current number of restrictions. These restrictions can be on any entity, or relationship. One can also create scenarios to explore how the network will change under different circumstances, such as demand change, cost change, or disruption. Selecting is a simple point-and-click or drag and drop exercise.

Once you’ve created the scenario(s) of interest (remembering that you can optimize multiple simultaneously in the online version), you launch them by selecting the type of optimization (the “technology”), the sub-type of optimization (the “problem type”), the horizon (the timeframe you want to analyze), and, optionally, override default parameters (if you don’t want to do a cost optimization but instead want to optimize carbon, service level, fulfillment time, risk, etc.). Then you run the scenario, and once the optimization engine works its math, you can explore the results.

The Model supports:

- Network Optimization

- Standard Network Optimization

- … with Network Decomposition

- … with Infeasibility Diagnosis

- Greenfield Analysis

- Cost-to-Serve Analysis

- Inventory Optimization

- Safety Stock

- Safety Stock & Service Level

- Safety Stock & Rolling Horizon

- Safety Stock Infeasibility

- Service Level

- Rolling Horizon

- Rolling Horizon Validation

- Demand

- Transportation Optimization

- Transportation – Standard

- Transportation – Interleaved

- Transportation – Hub

- Transportation – Periodic

- Transportation – Backhaul

- Transportation – Backhaul Matching

- Driver Scheduling

In short, it’s a very extensive network, inventory, and transportation optimization modelling solution out of the box that makes it really easy for supply chain and procurement analysts to build scenarios and solve them against all of the traditional models (and variants) they would want to run. (And if your particular variant isn’t out of the box, the SCP team can code and add the variant into your deployment as the underlying solution was built to allow for as many models as was needed as well as unlimited scenarios on those models.) Note that, by default, the platform will always run the baseline scenario so you have a basis for comparison.

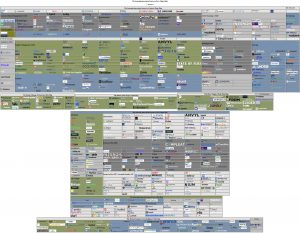

Results, which are output in the form of results tables, can then be analyzed in table form (by selecting the output table), graph form (by accessing the graphs), map mode (by accessing the map), or as a built-in or custom report/dashboards that the analyst can create as needed. For every type of analysis in the system, SCP includes a default set of dashboards for exploring the data set, which adapt to not only the type and subtype of optimization that was run, but the goal (objective function) as well. So if you did a cost optimization scenario, they summarize the costs. If you did a carbon optimization scenario, they summarize the carbon. If you did a service level optimization, they summarize the service level. If you did a carbon optimization relative to a maximum cost increase, they summarize the carbon and cost (and the relationship). In their platform, if you optimize one element or KPI, you can see the impact on all of the other costs and KPIs as all of the associated data is also output for analysis.

There is an output table for all elements which can be analyzed in detail, but most users prefer graph or map view on the relevant data.

Views provide custom, tabular, reports on the relevant fields of one or more tables, which can be exported to csv or pushed to another application for planning purposes. For example, if the model was a network optimization model, you can create a view that outputs the new distribution centres and fulfilment lanes for the revised network and push that to the TMS (Transportation Management System). If it was a transportation optimization model, you can output a table that specifies the carrier and rate for each lane, or, if necessary, each lane product combination and push that into the TMS. If it was a safety stock optimization model, you can output the product, location, minimum stock levels, and reorder points and push that into the Inventory Management or ERP system. And so on. There are default views for cost, carbon, service level, demand, and inventory optimizations, along with drill ins for relevant types of cost (site, production, by transportation type, etc.), but it is quite easy for a user to create a view on any table, or set of tables, with derived fields, with the view editor.

Graphs summarize the data in tables or views graphically, allowing for easy visual comparison. Select the scenario, select the data, select the graph type, and there’s your graph. They are most useful as components in dashboard summaries.

Maps provide a visual representation of the supply chain network — warehouses/distribution centers, customer locations, transportation lanes — overlaid on a real-world map with the ability to filter into particular supply chain network elements. There is a default map for the full network overview, and it can be copied and edited to just display certain elements.

Dashboards group relevant elements, such as a map of the current distribution network, a map of the optimized distribution network, a graphic summary of current distribution costs, a graphic summary of new distribution costs, and tabular (view-based) cost, carbon, and service level comparisons as the result of a supply chain network optimization scenario. These are typically custom built by the analyst to what is relevant to them.

Prescriptions, only in the online version of Supply Chain Modeller, are based on the 22 years of experience the SCP team has in building and analyzing models and uses advanced ML, simulation, and AI to automatically identify potential cost savings, and risk reductions and presents rank-ordered opportunities for you in each category, which you can drill into and explore. This solution automatically generates dozens (upon dozens) of scenarios and performs hundreds (or thousands) of analyses to automatically bring you actionable insights that you can implement TODAY to improve your network.

These savings will be grouped by type for easy exploration. For example, when it comes to cost savings, these will often be obtained by node skipping, mode switching, or volume consolidation — and the prescriptions module will summarize the prescriptions in each category, as well as summarizing the relative total savings of each category. A user can accept or reject each (sub) set of prescriptions, and then export all of the accepted prescriptions into new route definition records that can be imported into the TMS.

Note that the analysis that underlies the prescription analysis is very detailed, and in addition to the prescriptions, the platform will also identify the top network factors that are impacting the transportation costs, such as fleet distance, unique modes, certain carriers, country, etc.

When a user drills in, she sees the complete details of the prescription, including the before and after. In the node skipping example, they will see the current distance, products, quantities, (total) weight and volume, and current rates and then will see these in comparison to the new distance, new rates, and new costs. The old and new routes will be mapped side by side. The old and new lanes will be detailed.

The out of the box network risk summary for revenue at risk is quite impressive. The platform is able to compute the overall network revenue AND network profit at risk based on single sourced site-products, % of flow quantity single sourced, avg. end-to-end service times, and impacted paths. It will then do analyses to identify potential risk mitigation improvements allowing for 5%, 10%, and 15% network change (based on how product flows through the network with the current design) and compute the corresponding change in revenue and profit at risk as a result of those changes as well as the change in network cost. Usually the cost will increase slightly, but not always. For example, it could be that you could reduce the revenue at risk by 5% just through a supplier reallocation and network redesign, and if you were really risk averse, it could be that a 1% increase in network cost could result in an 8% to 10% decrease in revenue, and profit, at risk. And that could be the cheapest supply chain insurance you can buy.

Of course, you can drill into each model, the prescriptions, and the risk reduction with each individual change. It’s an extremely powerful tool.

Another thing that is really powerful in Coupa Supply Chain Solutions is the specific applications they can enable in the online App Studio, including the Cost-to-Serve App (which is just one example of the custom interfaces that can be built) that is one of the most complete dynamic dashboards for network insights that the doctor has ever seen. A summary can’t do it justice, but to whet your appetite to be sure you ask to see it in a demo, it has a full set of meaningful baseline KPIs, a visual network and flow summary, deep details on product costs and profitability, deep details on lanes and transportation costs, and so on. You can also quick-select a scenario to run and compare against the baseline in the app. It’s extremely well thought out.

Furthermore, you can build scripts in the App Studio to rebuild and run models on a schedule when you have a network in flux (because of disruptions, supply base changes, network changes as a result of prescriptions, etc.). And, of course, you can share these models and apps and dashboards with other analysts and democratize supply chain planning, easily enabling planners to analyze their own scenarios and make decisions collaboratively in a user-friendly App.

In short, Coupa has fulfilled the supply chain use cases we identified back in 2020 in Procurement, Finance, and Supply Chain Use Cases. It’s a great solution that you should check out, especially if you would like to have procurement and supply chain under one umbrella.