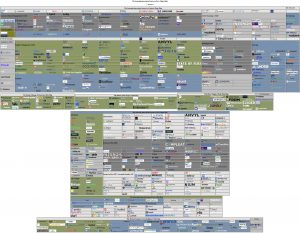

In our last article, where we described in detail the many, many reasons why logo maps (including the Sourcing Innovation Mega Map on Source to Pay+ with 666 Unique Clickable Vendor Logos which were verified to be valid as of 2024 April 13), we not only reiterated how these maps are mostly useless but explained that your mileage will vary widely between a map created by an analyst who’s likely seen 1/3 to 1/2 of the vendors in depth and a(n) (former) implementation consultant or (want-to-be) influencer from a CPO background who has no in-depth technology education or experience (beyond the systems he used).

Those who read between the lines would have seen this post coming — not only are they not appropriate for tech selection, any firm that relies solely on them or analyst firm 2*2s (which are great if you are searching for some holy smoke to keep the beast of procurement technology at bay) is also inappropriate for tech selection projects.

Your results with such firms will be about the same as the bigger firms with “consulting partner” status with all the (same) big players, as they will ultimately just recommend the same ten firms for your Tech RFP over and over again, whether or not they are the right firms (and solutions) to meet your needs.

In order to effectively select a set of potential solutions for a client, you need to, at the very least:

- understand the processes the client needs to support and the gaps they have

- understand the solution types needed to support the processes, and the client’s gaps in particular

- understand the client’s current technology landscape and Technology IQ, including what is replaceable and what is not (since, gosh darn it, some clients are going to hold onto that ERP they overpaid for until you dodge their six-gun pistols and pry the contract from their cold, dead hands)

- understand the client’s unique situation based on vertical/industry, market size, and geography/culture

- understand what global vendors support the processes, fill the gaps, synch with the tech stack, and can, possibly through third party integrations/partners, address the client’s unique requirements

This is a tall order. So tall in fact that, despite the growing demand for technology transformation and digitization across the Procurement landscape, outside of a few niche vendors that primarily focus on specific industries and specific solution types, the vast majority of procurement transformation shops aren’t able to fulfill it. Most will

- have the processes down pat, they are consultants after all!

- have a decent understanding of the common/core solution types, as they smart ones will actually read the expository articles written by the analysts (that they have access to anyway*)

Some, who employ technology and industry-specific professionals, will be able to build a decent understanding of

- the client’s technology landscape and technology quotient

- the unique requirements to look for/enable based on vertical/industry, organizational size, and geography

But few, if any will be able to:

- identify even a handful of relevant global vendors that take into account the first four requirements

This is because, as pointed out in our last few articles:

- the space is much bigger than they think, with

- more types of product offerings,

- considerably more vendors then they think exist, and

- considerably more than they can process

- they don’t have the deep technical background or technical understanding to differentiate between two vendors that speak the same and present applications that look the same in a 60 minute demo, but differ greatly in underlying power, extensibility, integration capability, etc. where you need a deep technical background and/or competitor understanding to tease it out (as well as a deep understanding of Procurement and the competitive [solution] market place)

- they don’t have a process to do a proper technical assessment, diligence, or tech analysis …

- and they certainly don’t know how to do a deep assessment by module/area to truly differentiate two solutions to qualify them as suitable for selection if they submit the best RFP

As a result, many consultancies will just do their in-depth process analysis, write up functional requirements based on that, and toss it over the wall to the solution providers to figure out, selecting from their partners if they feel there is enough overlap, then from the upper right in the analyst maps they paid for, and, finally, from the logo maps from their most trusted source. And, as we’ve explained, this doesn’t cut it and is why many sourcing / procurement software selection projects fail to live up to client expectations. Because, and we can’t say this enough, the most you can use logo maps / analyst 2*2s for is vendor discovery. Not validation for your projects!

Now, while the doctor has yet to receive an answer to his transformation process inquiries from any consultancy/service provider that fully satisfies him (he is demanding, after all), he is happy to say that, recently, a few# providers have acknowledged that transformation is going to require getting a lot more intelligent in tech and updating their processes and methodologies to recognize that, while it’s still The Wild West, it won’t be tamed by hope and grit alone — you’ll need the right tools to conquer it (and, FYI, those tools aren’t Gen-AI, they are good old-fashioned predictable, dependable steam- and gunpowder-powered tech solutions in the hands of us old and busted masters; the new hotness has nothing on us).

Secure Download the PDF! (or, use HTTP) [HTML]

(5.3M; Note that the Free Adobe Reader might choke on it; Preview on Mac or a Pro PDF application on Windows will work just fine)

* this is your regular reminder that Sourcing Innovation has never had a paywall and never will for baseline vendor coverage or expository posts; should SI choose to offer books, in-depth [comparative/market] intelligence, or similar IP services, for example, it may in the future sell this non-blog content, but every blog post will remain paywall free — almost 6,000 and counting …

# and we mean few, he can currently count them on his fingers on one hand, thumb not required