Billing itself as a platform that lets you enjoy a consumer-like buying experience with enterprise-level controls on existing e-commerce websites, BlueBean is a new solution for easy, compliant, organizational Procurement that lets you control your budget and pay less right from your browser.

Billing itself as a “request-to-pay” solution, the goal of the BlueBean platform, and the founders, is to simplify end-user buying in an average mid-market organization in a Procurement-compliant way without the need for intake, orchestration, and/or a traditional tail-spend / expense management platform that expects an underlying e-Procurement platform when most of the spend in such an organization is driven by users (due to there only being a few categories where strategic procurement is worth while and/or an understaffed central Procurement department). Moreover, the goal is to deliver a completely browser-based SaaS solution that doesn’t require a buyer to learn a new platform to make a purchase from a vendor who has, or sells through, an existing on-line e-commerce site.

So what is BlueBean? For the end-user, it’s a consumer-like “coupon manager” app (implemented as a browser extension) that runs in the browser and allows them to quickly:

- find preferred vendors for any product or service

- identify the (discount) codes they use on the vendor’s site to ensure the organization receives their (GPO’s) pricing

- request a virtual card for the product(s) or service(s)

- instantly receive that virtual card if the purchase satisfies all defined organizational requirements

- pay with that virtual card

- … and capture the e-commerce receipt for automatic submission to the Procurement/AP department

In other words, for the average buyer, with the exception that they have to pull down the in-browser app to find the allowed/preferred vendors, request the virtual card, and then access and use the virtual card (when the request is approved), it’s a super minimally intrusive Procurement app that allows them to buy in the traditional e-commerce style they are used to without having to learn any new Procurement systems. Compare that to even the modern orchestration systems where these same users would have to log-in to the enterprise app, use the wizards, or, even worse, try to converse with the Gen-AI engine (that shows them the latest pair of Nikes when they want brake shoes to fix the delivery truck), and then jump to either the organizational catalog, or, if they are lucky, punch-out to the e-commerce site where they populate a cart they then have to pull back. In other words, BlueBean makes the average orchestration system look like overkill. (As orchestration was another app developed for Enterprise customers that needed a lot of Procurement modules and solutions, not mid-markets.)

The founders of BlueBean, who have built a number of enterprise Procurement systems, realized that while you need a Procurement system for large(r), strategic Procurements, also realized that for “tail” spend, traditional Procurement processes and systems are overkill, and this is why you have people avoiding them and/or being non-compliant.

The founders of BlueBean also realized that in order for an organization to have proper spend management, even Tail Spend needs to be managed, and, more importantly, it needs to be captured. So they created an app that allowed for Procurement to manage this tail spend without requiring organizational users, who just have to use the browser extension, to learn new tools or processes, which distracts these users from the job they need to do.

So they built a simple enterprise e-Commerce platform that is like a punch-out catalog management, p-card management, tail-spend procurement, budget-management, and a paypal/stripe platform all rolled into one — which also simplifies the process and technology landscape for overworked and under-staffed Mid-Market Procurement teams who need to roll out something to manage the majority of enterprise transactions that doesn’t fall under the strategic procurement spend they barely have time to manage (when you include all the OT they likely have to work).

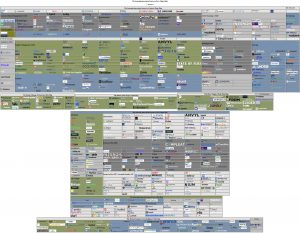

Right now, the just-launched BlueBean platform contains the following capabilities:

- Company Profile: the company profile (with subscription details)

- My Profile: the Procurement user’s profile and access details

- Account Details: the company’s expense account details — available and pending funding and linked bank accounts

- Virtual Cards: the virtual cards that have been issued, and the users / teams they have been assigned to

- Transactions: all transactions that have been put through the BlueBean platform (for the prescribed time-frame) (with receipt attachments)

- Spending Limits: by person or team (or category, as a team can be setup per category)

- User Management: the platform users (with their details, limits, etc.)

- Savings MarketPlace: the sites that have been approved for organizational buying by the organization (from the BlueBean marketplace or the organization’s GPO marketplace), organized by category, broken down by savings plan (to keep track of each GPO, department, etc.)

- Preferred Stores: the e-commerce sites that the organization has marked as preferred

- Statements: monthly P-Card-like statements that can be downloaded or exported to your accounting system

- Reports: simple, on-line, dynamic spend breakdowns by category, time-period, team/user, etc.

- Security: security configuration

And, as noted, BlueBean allows for direct export of all transactional data, with receipts, into the accounting platform for full spend tracking and classification (by vendor and default category), which allows more organizational spend to be (at least minimally) under management.

It’s a very neat solution for a mid-market organization that needs to get tail-spend / end-user spend under management and under control, but doesn’t have a large Procurement team, the resources to train organizational users, or the time to impose full Procurement processes on organizational users who just need to get a job done. So, if this sounds like something your organization needs, even though they are the new kid (on the block), the doctor would recommend checking out BlueBean and giving your organization the caffeine-rush it desperately needs. It’s serving a niche that hasn’t been effectively served yet (as most existing Tail-Spend solutions were defined for larger organizations and most orchestration platforms require one or more Procurement solutions to already be in place, and a mid-market Procurement team doesn’t have the manpower, budget, or time to manage more platforms than absolutely necessary). The minimal imposition will make your end users happy (and that leads to adoption).