INTRODUCTION

When their founders were young men

they paced the fact’ry floors

from Vellore down to Chennai

they must have walked ’em all

cause they learned all of the problems

that plagued the Procurement side.

Those listen, look, and learn guys

sure made a lean platform.

The founders of MeRLIN, who started Rheinbrucke Consulting in 2013, started developing a stand-alone application for direct source-to-contract (and, for those who need it, source-to-pay) in 2018 using their decades of experience supporting direct manufacturing clients. MeRLIN was then frst released it to the market in 2022, after ensuring it actually solved the problems they were seeing and met the needs of the companies they were working with.

(While some companies might take it as a badge of honour to get a “minimally viable product” to market in a year, the reality is that when it comes to manufacturing enterprises, nothing you can develop in a year will actually solve more than a fraction of their problems, and unless what you deliver can integrate tightly into their existing enterprise software landscape, it won’t be adopted, or even bought. That’s why there are so many offerings in indirect [many of whom will succumb to the marketplace madness] and so few that offer true direct sourcing solutions, and fewer still that offer fully integrated source-to-contract / source-to-pay suites.)

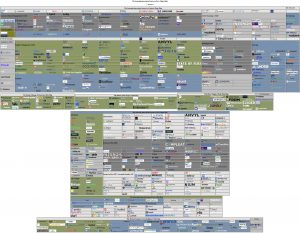

PLATFORM SUMMARY

MeRLIN, which bills itself as a Source-to-Contract platform for Direct Material (primarily Discrete Manufacturing) Sourcing, is actually a Source-to-Pay platform where the Procure-to-Pay platform capabilities are baseline (and wouldn’t go head-to-head with best-in-class) and designed for the mid-market (and large enterprise) clients that don’t have a Procurement solution in place already (either through the ERP, AP, or a third party system). Since most larger enterprises have some form of decent P2P, MeRLIN decided to focus primarily on the critically underserved strategic sourcing marketplace in discrete manufacturing and direct sourcing and the capabilities all of the companies the founders worked with in manufacturing were universally missing.

MeRLIN was designed as a modular solution where

- a client could license just the modules they wanted/needed,

- common modules, and capabilities, were broken out into their own modules so their was no duplication of functionality, and

- key modules could be augmented with additional value-added functionality not typically found in average products.

MeRLIN has all the standard modules you’d expect in a Source-to-Contract:

- (Program &) BoM Management (Requirement for any Direct Solution)

- Requisition Management (Intake)

- Sourcing (Event) Management (Sourcing)

- Supplier Management (SXM)

- Contract Management & Contract Authoring (CLM)

- Reports & Dashboard (Reporting & Analytics)

As well as basics for Procure-to-Pay:

- Purchase Order Management

- Invoice & Payment Management

But also has modules for:

- Demand Management (Consolidation of Requirements from Requisitions, Manufacturing Programs, and MRPs)

- Category Management (Part/BoM grouping & management)

- Supply Chain Compliance (GSCA / LkSG)

- Supply Management (Document & Shipment Management)

and the standard suite foundational modules of:

- Master Data Management

- Business Administration

- Security Management

- System Management

And even modules for:

- Strategic Project Management (Project Management/Orchestration)

- Finance Management (Budgets, Prices)

We’re not going to discuss all the modules and instead focus in on just the core Source-to-Contract modules, as they are the modules that are critical to direct sourcing and the modules that will allow you to understand the value, and potential, MeRLIN has for you.

Supplier Management

Supplier Management is designed to onboard, evaluate, approve, and manage suppliers, including their contacts, surveys, ratings, and documents. Qualification starts with a simple request based on supplier name, country, email, and unique (DUNS) identifier. Based on the supplier category, the next step will be to send the suppliers the qualification surveys and pull in the external risk information, send it to technical and risk reviewers, and if that passes, it will go off to compliance to ensure the supplier can comply with all necessary regulations the company is subject to and then, if that passes, the supplier will get a registration invite to provide all of the additional information necessary to do business with the company as well as details on additional products and services.

Supplier Management captures all of the core company information, locations, accounts, questionnaires, risk information and scores, compliance reviews, scorecards, and approvals. For each of these there are standard fields, and as many additional fields can be added by the customer organization as needed.

Compliance Management

Collects and manages the organizational policies, supplier policy statements, compliance surveys, audits, risks, scorecards, and complaints. It can accept all documents, support custom surveys, import third party data from financial and environmental (and other) risk providers, provide you with compliance scorecards, and automatically extract and centralize all “risks” from the surveys based on scores and/or responses in a risk management view.

Moreover, in full compliance with the German Supply Chain Act (GSCA, known as the LkSG within Germany), MeRLIN provides the buying organization, each of their suppliers, and their entire employee base, a unique portal where they can register complaints. They have upgraded their platform to fully support the GSCA and can also support other supply chain acts as well (and future releases will encode more out-of-the-box support, even though it can already be custom figured on a client-by-client basis to support the majority of acts out there).

Requisition

Requisitions can be used as traditional requisitions for purchase orders against existing contracts for goods and services normally used by the company or as intake requests for sourcing. When they are used as intake requests, they go to a central management screen where the buyer can group them by material, bill of material, and/or category to identify sourcing event requirements and then create a sourcing event off of a bundle of them.

Sourcing

Sourcing is primarily RFX based, but auctions are supported as well off of base RFQs. A sourcing event can be kicked off from one or more requisitions, a category, a BoM, or an event template, which can consist of one or more RFIs, questionnaires, and line-items with custom price breakdowns in the RFQ. Associated with the RFQ can be the suppliers, addendums, budgets, stakeholders, terms and conditions, contract template, event schedule, and ongoing Q&A.

In addition to being able to review bids by total cost per unit and evaluation score (by the relevant stakeholders), the application also supports automatic award recommendation by criteria which can include target award by supplier, range of suppliers to split the award between, minimum and maximum shares, and preferred supplier status.

Contract “Authoring” & Management

The platform is primarily “signature” and “execution” management, as authoring is simply the packing up of contract templates, terms and conditions, specifications, and associated addendums for agreement by electronic signature. The electronic signature capability is compliant with USA regulations and most European regulations for private enterprise contracts. Once the contract is signed, the platform can manage the project timeline, stakeholders, documents, events, milestones, and obligations. In addition, the user can define alerts against any event, milestone, document, obligation or other entity on status change or due date.

Reporting & Dashboards

Reporting and Analysis in MeRLIN is through widget-based dashboards that summarize any data of interest in the system. Right now there are hundreds to select from in the reporting library, with more being added as needed. For each of the built in reports and dashboards (on suppliers, spend, process, etc.), the user can apply multiple filter options and save the configuration to their liking. There is no Do-It-Yourself (DiY) widget report builder yet, but more DiY analytics enhancement is on the roadmap.

Strategic Project Management

This is MeRLIN‘s built in project management capability where a user can define and instantiate RFX templates, supplier onboarding workflows, contracting processes from award specifications, procurement processes, and even entire Source-to-Procure projects which collect all of the necessary templates and workflows together. In addition, leadership is provided with a high level overview of sourcing projects.

Master Data Management

All of the system master data templates can be altered by the user including, but not limited to, currencies and conversions, items, locations, plants, prices, suppliers, contract metadata and milestones, and other key items. The customer can control it’s master data and master data identifiers.

Business Administration

All of the templates in the system can be managed and customized in the business administration section including, but not limited to supplier onboarding, qualification, evaluation, and audit questionnaires, product and item templates, requisitions, RFQs, purchase orders, contract terms, contracts, statements of work, email, and workflow templates.

Bill of Materials Manager

A key aspect of Direct Sourcing is managing the Bill of Materials. In the Merlin platform, that can be done through the BOM Manager, which unlike basic direct sourcing platforms, can maintain as many versions of a Bill Of Materials as the organization wants to maintain (for correlation with historical sourcing and procurement and cost estimates during new product design and/or product modification).

These versions can be uploaded from the ERP (or your PLM of choice with custom integration) or created in the BOM Manager, and this creation can be from scratch or from a previous BoM version which can be copied and modified as needed.

The best part of MeRLIN‘s BOM manager is its built-in ability to allow for easy should-cost analysis during NPD and BOM (re)design. Once a BOM has been uploaded or created, the user can click a button to “cost” and it will automatically find prices for every component in the BOM for which it has a price from a contract (first), catalog/commitment (second), or quote (third). Then, the user can push the remaining items to the Demand Management module for quick quote (or import into the internal catalog from a connected source) or simply create a place holder item (with an estimated cost). They can then return to the BOM Manager and re”cost” the BOM to get a complete cost estimate, which can be compared against the cost of all prior BoM versions (that were costed). This allows the organization to understand the costs associated with BOM changes over time (independent of supplier or distributor pricing changes). Gone are the days where you have to use a completely separate application to do BOM cost estimation.

Finally, the next update to the BOM Manager will allow for the user to enter a cost estimate directly in the BOM manager for materials/parts not yet quoted for even quicker price estimates, and those estimates will be clearly marked as internal estimates only.

Other Capabilities

We’re not going to discuss the procurement modules as they are not MeRLIN‘s focus (but we will assure you that they cover the foundations if you don’t have P2P and need it), demand management as you know what forecasting should do, category management (and category strategy management) as that is rather self explanatory, or finance management, as budget and price management is also straight forward.

The Full Picture

The platform is quite deep in all core areas and one could write pages about each module and its deep capabilities, but hopefully this is enough to convey the facts that

- the MeRLIN platform was designed from the ground up to support direct and discrete sourcing,

- has the capability to support these projects from inception to contract signing through the very last order against the award, and

- goes beyond just raw sourcing capability to related capabilities of supplier risk, compliance, and execution (tracking the order to the delivery and qualification)

CONCLUSION

Given the relative lack of true direct and discrete sourcing platforms in the mid-market, MeRLIN is a platform you should definitely be aware of. If you’re in direct manufacturing, automotive, aerospace, and related industries, you might want to check them out today.

It’s for discrete wizards,

it’s a platform with a twist.

A discrete wizard

needs a tech assist …